A progressive tax change is one that it benefits those on lower incomes more than higher incomes.

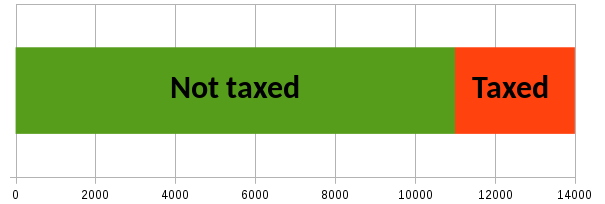

Let's consider what raising the Scottish rate of income tax by 1p means. The bar below shows the income of someone who's on the minimum wage, earning about £14,000 (before tax) per year. This is in the bottom 25% of incomes in Scotland.

The green bit on the left is the personal allowance. You pay zero tax on that. It's £11,000 (using 2016-17 figures), so tax is only paid on the £3000 shown in red. At the moment the basic rate of income tax is 20%, so the tax that needs to be paid on this is:

0.2 × £3000 = £600

If this is bumped up to 21%, as proposed by the Lib Dems and Labour in Scotland, then the tax due goes up to

0.21 × £3000 = £630

That's an extra £30 a year or 58p per week.

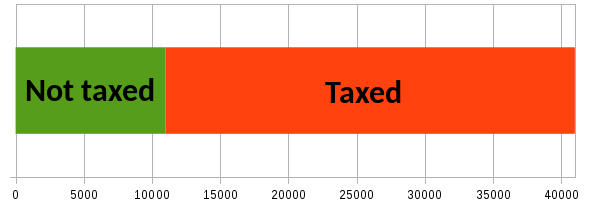

Let's now consider someone who's on a much higher income of £41,000 per year. This is just enough to be in the top 25% of incomes in Scotland. The bar for them looks like this:

As before, the green bar is the personal allowance of £11,000 on which you pay no tax, but now a much greater proportion of the income is red. This person will pay tax on £30,000:

0.2 × £30,000 = £6000

Let's pause to appreciate what these calculations are telling us: this person has a taxable income that is ten times greater than the minimum wage person, and so they pay ten times the amount of tax. Putting the tax rate up to 21% gives:

0.21 × £30,000 = £6300

We can summarise the tax rise for these two people as follows:

| Income | Tax rise | Tax rise as % of income |

|---|---|---|

| £14,000 | £30 | 0.2% |

| £41,000 | £300 | 0.7% |

So there is a larger rise in tax for the person with the higher income whether we look at it in pounds, or as a percentage of income. In other words, this is very definitely a progressive tax change. That said, the rise is fairly modest, being only 0.7% for the higher earner.

The person on the lower income is having to pay more tax, but they are still likely to benefit overall for a couple of reasons. Firstly, some of the increased tax take can be returned explicitly to low earners, as Scottish Labour propose with a £100 annual bonus. Even without this, folk on lower incomes are likely to rely more on state services (education, health, social care etc) and so will benefit if the extra tax is spent on those things.

Both the examples above involve only the basic tax rate. Because of the way the Scottish rate change works, all tax rates get bumped up by 1 percentage point: the higher tax rate will go from 40% to 41%, and the additional tax rate will go from 45% to 46%. Also, as you go to higher incomes, the personal allowance becomes a smaller proportion and so the tax rise as a percentage of income will rise from the 0.7% in the table above to approach 1.0% for salaries over £100,000. (The personal allowance actually goes to zero for incomes above £122,000.)

Clearly, 1% of a big income is much more than 0.2% of a minimum wage income. But aren't there far fewer high earners? There are, but that's a subject for another blog post. For now, mull over the implication of the following fact: higher-rate tax payers — that is, those earning over £43,000 — contribute about two-thirds of all income tax collected.

The question is therefore not whether such a tax rise is a progressive policy — it clearly is — but whether to support it. Personally, I do, as I am willing to pay a bit more tax to help those less well off and to fund local services, particularly schools and care for the elderly. There are possible downsides, such as higher income folk moving out of Scotland, but I think those risks are fairly low and outweighed by the likely benefits.

A spreadsheet with all above calculations, references and more background data can be downloaded in ods or xlsx format.