I've now completed reading book

III of The General Theory by John Maynard Keynes. I previously wrote about my thoughts on books I and II. The

title of book III is "The propensity to consume" and it is composed of

three chapters.

I've now completed reading book

III of The General Theory by John Maynard Keynes. I previously wrote about my thoughts on books I and II. The

title of book III is "The propensity to consume" and it is composed of

three chapters.

Probably the most important statement made

in this part is in Chapter 3, section II, paragraph 2:

Thus, to justify any given amount of employment there must be

an amount of current investment sufficient to absorb the excess of

total output over what the community chooses to consume when

employment is at a given level.

Out of context the meaning may

not be clear, so I'll try and explain in my own words, using a very

simple model of my own devising.

Consider a simple, closed economy which comprises a number of companies and a community of people - the consumers - who will buy products from those companies. The economy is closed in the sense that it does no trade with any other companies or consumers elsewhere, i.e. there are no imports or exports. Let's also suppose there is no taxation or spending by a government.

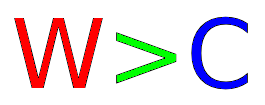

So each one of the consumers are either employed by a company or else they are unemployed and have zero income (the government doesn't spend, so there is no welfare state). The ones who are employed receive a monthly wage from their company. Let's add up all the wages across this community and call it W. Also, each consumer will spend a certain amount each month. Let's add up all that is spent and call it C.

Each company will have an income, and if we add up the income from selling to consumers across all companies we must find that it comes to C - the total the consumers have spent. One company can sell to another company and so we can add up the business-to-business income across all companies and call it B.

The costs of each company will be the amount it pays out in wages plus the amount it spends on buying from other companies. Adding up wages across all companies must give us W. Because this is a closed economy, the total spent on companies buying products must be B.

So the total income of all companies is C+B and their total costs are W+B. The total profit across all companies is therefore C-W (the Bs cancel out).

And you may have spotted the problem with this simple economy. People will generally not spend more than they earn (and even if they do, they can not do so indefinitely). This means that the total amount spent on buying products from companies C will have to be less than the total wage bill W, or, in other words, the companies in this economy must make an overall loss of W-C. Of course, there will be winners and losers - profitable companies and loss-making companies - but overall companies are loss making in this economy.

A company that finds it is

making a loss will try to drive down its costs. It can do this by

reducing what it pays to other companies, and it will probably also

reduce its wage bill, either by cutting wages or by firing employees.

The overall result will of course be to drive down B and W, though B

has no impact on the overall profitability of companies. But, as we

argued above, C cannot be greater than W, so if W is decreased, C will

decrease too. In fact, employees who are starting to fear for their

jobs are likely to start saving and so the total amount they spend C

will probably fall by even more than W and so the overall loss W-C may

even increase. In any event though, W will remain greater than C.

This effect is an example of positive feedback in that the

fact that W is greater than C will cause companies to act in a way

that will cause W-C to increase. In this way, without any other

stabilising factors, the economy will collapse: all companies will go

bust and everyone will become unemployed.

And this is where

the quote from Keynes above becomes relevant. To stop this happening,

the companies, as a whole, need to receive monies from another source

to offset the loss they collectively make, i.e. W-C. This extra source

of monies Keynes calls "investment". And where does it come from?

Well, in this simple economy it can only come from what the consumers

don't spend on goods. Instead they either use their savings to buy

shares in a company or save the money by putting it in banks that then

invest or lend the money to the companies. And, of course, this excess

of consumers income over spending is exactly equal to W-C, which means

this economy can be made stable in the sense that companies can break

even overall and so the level of employment can be sustained.

The essential point that Keynes is making here is that investments

and savings in an economy are necessarily equal. I had previously only

thought of investment as being necessary for companies that want to

grow or establish themselves as start-ups. Although that's true, I can

now see that continued investment is a necessity to sustain a stable

economy because of the gap between C and W.

The other point which Keynes makes is that an economy that has reached a stable equilibrium may have done so at less than full employment. It may well be, and in fact generally is the case, that the willingness to invest and the propensity to consume are not sufficient to motivate companies to increase their production and take on more employees. The unemployed who have zero income (there is no welfare state in my model) would clearly prefer to work, but the companies will not employ them because they cannot see how this would maintain or increase their profits. This conclusion, that an economy can be stable at less than full employment, distinguishes Keynes's theory from that of classical economics (at least of his own time, but I bet there are still many who do not get this point today).

There are a number of other interesting implications that can be drawn from this simple model. One is to consider what happens if hoarding rather than saving occurs in the economy. For example, an old miser who distrusts banks, stuffs all excess money under a mattress. Likewise, a bank that takes deposits but refuses to lend is doing much the same thing. The result in both cases is that money enters a stagnant pool and the economy as a whole will suffer because it is deprived of investment. If money could be released from that stagnant pool, then employment could rise because companies could access a new potential source of revenue. Of course, in my simple model there is no government to spend, but in reality, government spending can achieve the same result in raising employment.

But, if there's one lesson to take away from this simple model, it is that "one person's spending is another's income", or more specifically, "consumer spending is company revenue". Companies as a whole are completely beholden to their consumers. If consumers do not part with their money to buy products, then it is their savings transformed into investments which keeps the companies in business. This raises an interesting question: how does this fit with the current situation in which the richest 1% of the population, who presumably own companies, are often supposed to be syphoning wealth from the 99%? I'm still pondering this question, but will save my attempts at an answer for a future blog post.