The argument for austerity goes like this:

- The public debt is too high so businesses and consumers lose confidence which hampers economic growth.

- If the government is seen to be reducing public debt then confidence will be restored.

- Confident business will invest and become more efficient, and sell more products and services because of consumer confidence.

- Hence the economy will grow.

What follows is my attempt to simplify the argument against austerity to its essentials.

Public and private sectors

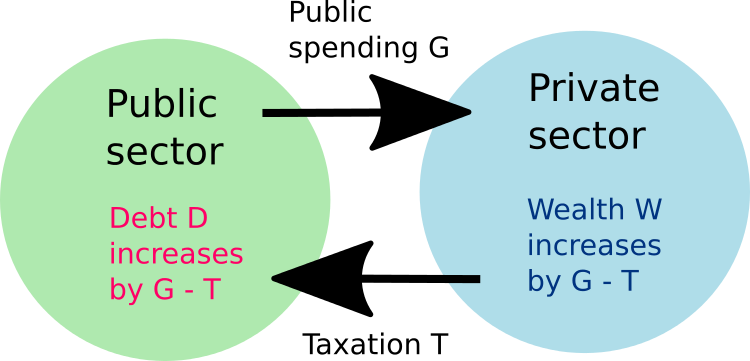

The public sector of a country will spend into the country's private sector for many reasons, including paying a nurse, building a school or constructing a warship. Let's call the total spent in a year G.

Private sector funds flow to the public sector as taxes such as the VAT when a car is purchased, the income tax when a person is paid and corporation tax on a company's profits. Let the total amount of a money that flows from the private to the public sector in a year be T.

Since G goes into the private sector and T comes out, the increase in private sector wealth W is

Change in W = G - T

and the shortfall in the public sector — the budget deficit — is met by borrowing, i.e. increasing the public debt D, so

Change in D = deficit = G - T

In plain English, the above means that the increase in private wealth is equal to the deficit. Conversely, if the deficit is negative — a surplus — the private wealth must decrease by an amount equal to the surplus.

The decrease in private wealth is equal to the surplus.

This is an accounting identity. There's no clever (or stupid) economics going on, just simple arithmetic. Also, this argument does not assume anything about growth (or inflation).

The aim of austerity is to reduce the public debt. To do this you must first reduce the deficit and in time create a surplus. The surplus can then be used to "pay off" the debt. This entails either a cut in public spending G or a rise in taxes T. Either way the effect on private wealth will be the same:

Austerity will cause private wealth to decrease.

And this is the crux of the argument. A drop in private wealth will cause consumers to spend less on products and services, and this will in turn reduce the revenues of businesses who will also be less likely to invest for the future. This is a recipe for recession, not economic growth.

Paul Krugman criticises austerity saying that it requires a belief in the confidence fairy. If the confidence fairy does exist then its magical powers lie in persuading businesses to invest more, and consumers to consume more as they get poorer.

Austerity in the UK

Growth is currently respectable in the UK economy. This is because the government is nowhere near achieving its desired annual surplus which, according to its own plans, should've happened by 2015. Wages adjusted for inflation are only just back to their pre-recession levels and so the growth must in part be fueled by consumers funding their purchases with debt, which is consistent with the rise in overall private debt. It is also possible that some consumers are funding their purchases by spending their savings (dissaving in economist lingo). Neither is sustainable.

In discussing the private and public sector balances above I didn't include the effect of imports and exports. I won't get into that here, but the bottom line for the UK is that the private sector is currently having its wealth drained because the UK spends more on imports than it receives from selling exports. So if the surplus is achieved this will be in addition to the wealth drain due to foreign trade.

Public debt isn't just debt

Separate to the argument just made, there is a more fundamental point that fells the case for austerity at its base: high public debt isn't necessarily a problem for a country like the UK that has its own currency and central bank. This blog post by Frances Coppola explains this point very well.